Introduction

Analytics and reporting tools can help providers that participate in Alternative Payment Models (APMs) measure the pulse of their program performance and provide helpful insights into their population health and risk levels, as well as uncover the potential for lowering cost and improving care quality.

Generally speaking, APMs are structured such that providers are measured against a benchmark in a given performance year (PY). Depending on the particular APM structure, the providers share in any savings and/or get paid bonuses based on their performance. If they are in a downside risk model, they may also have to contribute to covering the overages against the benchmark. Some APMs, such as Primary Care First and Direct Contracting, provide capitation payments for the beneficiaries that are attributed to that entity.

Types of Medicare Payment Models

Although APMs vary in design, they all share a similar aim to restructure payments in a way that financially incentivizes low-cost and high-value care. Some different types of Medicare APMs include, but are not limited to:

- Medicare Shared Saving Program (MSSP) is the flagship CMS APM in which Accountable Care Organizations (ACOs) participate in one of several tracks corresponding to different levels of assumed risk. The ACO shares in the savings, or in some tracks the losses as well, resulting from their performance compared against a benchmark.1

- Global and Professional Direct Contracting (Direct Contracting, or DC) Model is a voluntary, six-year model that offers partially or fully capitated payments for Medicare Part A and Part B services. It features two distinct tracks: Professional Option and Global Option.2 Learn more about the DC model and what tools CareJourney can provide.

- Primary Care First (PCF) is a voluntary, multi-payer, five-year program that operates in 26 different regions of the country and offers enhanced payments to support advanced primary care services. Learn more about the PCF model and what tools CareJourney can provide.

- Kidney Care Choices (KCC) Model builds on the ESRD Care Model and adds fixed payments for clinicians who manage care for Medicare beneficiaries with late-stage chronic kidney disease and ESRD. Learn more about the KCC model and what tools CareJourney tools can provide.

- Bundled Payment Programs provide a single payment for an episode of care including BPCI-A, a voluntary model which covers eight clinical episode service line groups, and the Radiation Oncology Program, which is a mandatory program covering thirty percent of radiation oncology practices that provides bundled payments for the radiation treatments for 15 different types of cancers.

There are many metrics that an APM participant needs to monitor to maximize their success, such as provider performance on cost and quality metrics against benchmarks, the health of their patient base, and how seamlessly and efficiently their patients are transitioning to and from specialists. One key metric is understanding how many and which beneficiaries are attributed to their providers. With CMMI’s newly announced 10-year goal of getting 100% of Medicare beneficiaries into value-based care arrangements by 2030, beneficiary attribution should grow to much larger numbers.3

Participating in the ACO REACH Model?

Learn how to be successful in the model.

Part of the Medicare Shared Savings Program (MSSP)?

Learn how to improve performance in MSSP.

Beneficiary Attribution

Patient attribution defines a patient-provider healthcare relationship with the goal of achieving better quality and outcomes at a lower cost for the patient or payer, and is a critical component of APMs. In total cost of care models, patient attribution holds providers accountable for managing the full continuum care of their patients in exchange for capitation payments. Knowing which beneficiaries are attributed to a particular provider organization allows these APM participants to accurately plan for capitation payments, insightfully manage their population health, and plan for how to perform best in order to maximize their savings and quality payments.

CMS uses slightly different attribution methods across the various APMs. Understanding these nuances can be critical, since knowing which beneficiaries will be assigned to which providers in an upcoming PY can help project expected costs associated with an APM, as well as the risk adjustments and other adjustments that play into those financial projections. For the purposes of this blog, we are using Direct Contracting as an analytics case study to illustrate the ways in which CareJourney can help APM participants better understand their attributed beneficiary population.

Direct Contracting as a Case Study in Attribution

Direct Contracting is a voluntary six-year APM in which a Direct Contracting Entity (DCE) contracts with “Participating Providers;” providers that are contractually obligated to accept an agreed upon rate from the DCE for their services. Participating Providers are typically primary care physicians, but may also include certain specialties. DCEs also associate with “Preferred Providers;” providers that are not contractually obligated to receive payment for services from the DCE. Preferred Providers may opt to file claims with CMS for their services under traditional Fee-for-Service (FFS), or they may choose to be paid via a separate contractual agreement with the DCE. Depending on the DC program type, some DCEs take a partial capitation payment for primary care services, whereas some DCEs take a full capitation payment and are responsible for their beneficiaries’ total cost of care. DC seeks to learn from commercial programs and provide beneficiary enhancements such as care coordinators, three-day SNF waivers, and additional home healthcare and telehealth options.

There are several types of DCEs that may participate in the model:

- Standard DCE: organizations that have substantial history serving Medicare FFS beneficiaries, including dually-eligibles, who are aligned to a DCE through voluntary or claims-based alignment. Standard DCEs must have at least 5,000 aligned beneficiaries.

- New Entrant DCE: organizations that have no prior experience serving Medicare FFS beneficiaries and will rely on voluntary alignment in the first few years of the model. New Entrants DCE must have at least 1,000 aligned beneficiaries for their initial PY, with an increasing threshold each year up until a required 5,000 for PY five and six.

- High Needs Population DCE: organizations serving Medicare FFS beneficiaries managing patients with complex needs who are aligned through voluntary or claims-based alignment. High Needs Populations DCE must have at least 250 aligned beneficiaries with an annually increasing threshold each year to 1,400 prior to PY six.

Beneficiary Alignment in Direct Contracting

Prior to the beginning of each PY, CMS provides each DCE with a list of their aligned beneficiaries. In order to be eligible for alignment, beneficiaries must have had at least one relevant primary care service rendered by the provider during the alignment period. These beneficiaries are alignment eligible in a given month if they meet the following criteria:

- Are enrolled in both Medicare Parts A and B;

- Are not enrolled in an MA plan, Medicare Cost Plan under section 1876, Programs of All-Inclusive Care for the Elderly (PACE) organization, or other Medicare health plan;

- Have Medicare as the primary payer;

- Are a resident of the United States; and

- Reside in a county included in the DCE’s service area.

Alignment eligible beneficiaries become aligned to a DCE through one of two methods. The primary option is through a claims-based approach, where patients are aligned to a provider based on the plurality of allowable charges for qualifying primary care services within a designated period. Claims-based alignment has a two-year alignment period that ends six months prior to the beginning of the PY. For example, for PY2022, beneficiaries are aligned to a DCE based on which provider qualifying services that occur between July 1, 2019 and June 30, 2021.

Alternatively, patients can become voluntarily aligned to a DCE by selecting a primary care provider with whom they want to have a care relationship. This selection can be completed via a paper-based form or electronically, through MyMedicare.gov. Voluntary alignment takes precedence over the claims-based approach.4

The Potential to Lose Aligned Beneficiaries

Understanding alignment and the analytical approach behind determining an ACO’s target population is a key component to a program’s success. For the DC payment model specifically, meeting the patient threshold to qualify for program participation is emphasized, especially for entities who tread the line in terms of patient volume. DCEs receive monthly partial or full capitation payments, therefore accurately understanding the number of beneficiaries aligned to them is vital to their financial planning and success.

Through the use of claims data, entities can better understand who is aligned to them, who has the potential to be on the alignment track, and who is at risk of churning out of the program. Beneficiaries may become unaligned to a particular DCE via a few mechanisms. On an annual basis, the claims-based alignment algorithm can deem beneficiaries ineligible for alignment if they did not receive a primary care service or the algorithm can align them to a different DCE based on the plurality of allowable claims during the requisite alignment period. In addition, beneficiaries become ineligible and therefore unaligned (at any time during the PY) for the following reasons:

- Death during the PY;

- Loss of core Medicare Parts A and/or B coverage;

- Moved outside of an applicable service area;

- Transition to Medicare Advantage coverage; or

- Become attributed to another Medicare shared savings initiative, which can include an aligned beneficiary migrating to another DCE through the voluntary alignment approach.

It is important for these APM participants to understand their potential to grow, while at the same time understand their risk of volume. The data provided to participants can be used to help project general alignment direction and help participants position themselves in such a way that can further their potential to grow and succeed. Understanding these details can help participants combat volume loss through interventions, such as patient engagement and/or the encouragement of voluntary alignment.

CareJourney Analytics for Provider Recruitment and Retention

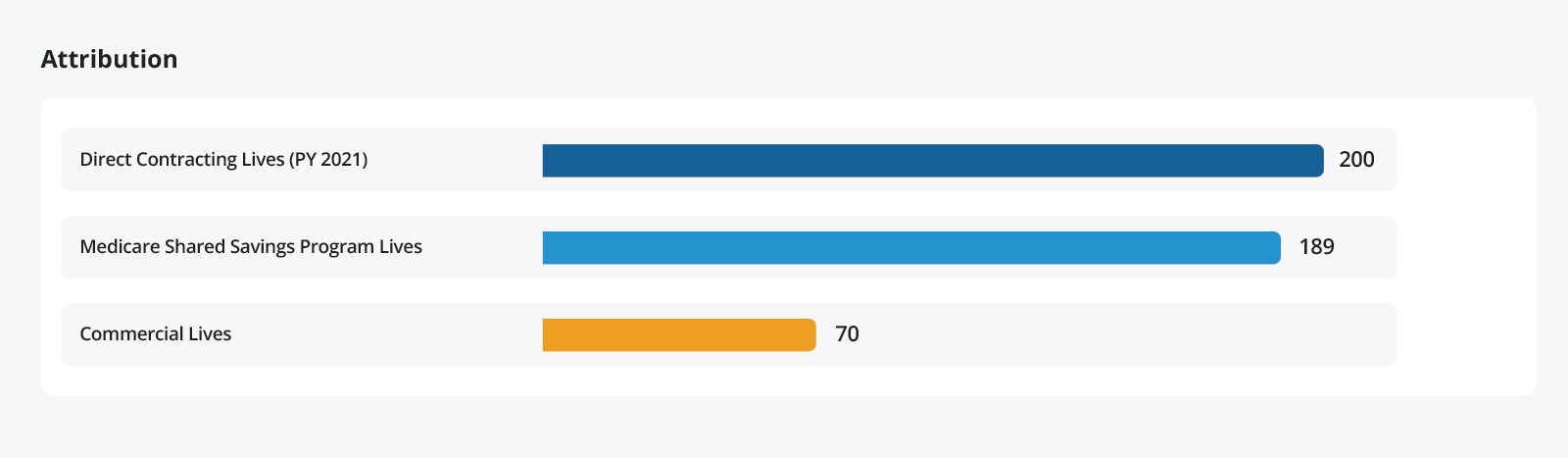

Using CareJourney’s analytics platform, CareJourney members can understand the volume of patients attributed to providers under the various APMs. Whether that is the MSSP attribution needed for ACOs or the attribution methodology used to align patients to DCEs, CareJourney analytics allow members to determine the potential volume a provider would bring with them if they participate in one of these payment models.

In addition to the current attribution information, CareJourney has longitudinal data that allows members to trend the attribution over time and perform volume analysis for providers. Members can view the direction of provider volume growth by examining the history of provider attribution.

Analyzing this data can yield compelling insights, more compelling than the trends over time. CareJourney’s analytics tools allow members to understand the details of their attribution and identify strengths and weaknesses. For example, using our primary care spend analysis for DCEs, members can determine the proportion of their population that is “strongly” aligned with the provider, allowing them to assess the magnitude of the potential realignment risk to the claims-aligned patients.

| Aligned Beneficiary Information | |||

|---|---|---|---|

| Aged & Disabled | End Stage Renal Disease | Total | |

| PY 2021 | PY 2021 | PY 2021 | |

| Total Aligned Beneficiary Count | 8,071 | 0 | 8,071 |

| Alignment Strength… | |||

| Strongly Aligned Beneficiary Count | 4,759 | 0 | 4,759 |

| Loosely Aligned Beneficiary Count | 2,942 | 0 | 2,942 |

In this example organization, about 60% of claims-aligned members are strongly aligned to their provider, meaning that 40% of their members are at significant risk of re-alignment through the claims-based approach due to the fact that they’re receiving primary care services from more than one provider.

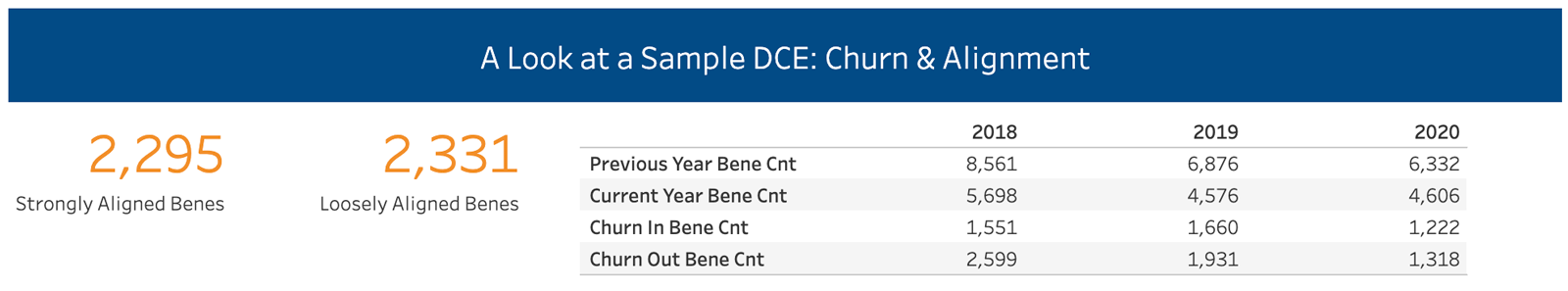

Another example of how this data can be leveraged is by examining the year-over-year churn of beneficiaries through a DCE. CareJourney provides a report that demonstrates the volume of beneficiaries that are moving in (and out of) the DCE year-over-year, in which members can then leverage to dig deeper into the reasons for this churn and identify the specific reasons of why their DCE may be losing volume.

After reviewing prospective providers’ attributed volume, members can also leverage our analytics to understand the costs associated with their attributed patients. Once again, examining MSSP or DCE attributed populations, members can view the spend and risk scores associated with those patients, which allows for a comprehensive assessment of the providers’ cost performance. This allows DCEs to determine which providers will be the greatest assets to their organizations and target recruitment efforts to those providers. Additionally, CareJourney provides special analytics tools to ACO and DCE members that simulate the performance of providers or practice groups together as a whole against either regional benchmarks or an estimate of the DCE’s own benchmark expenditure. These tools can also assist decision makers in determining which providers that aren’t currently in their ACO or DCE network might bring in additional aligned beneficiaries, and how strongly aligned those beneficiaries might be.

Leveraging these tools allows CareJourney members to understand which providers are likely to be high performers that drive improvements in cost and quality. This data also allows for advanced analysis by spending type, enabling performance managers to identify the areas which have elevated spending levels and target interventions to decrease costs.

Utilizing CareJourney’s tools allows participants in APMs to (1) understand their current providers’ attribution of patients (2) estimate how that attribution may change over time by adding new providers, and (3) determine the appropriate levels of spending that will be occurring on the attributed population and understand where and why spending above those levels is occurring.

Access a Sample DCE’s Churn and Alignment Data

See how churn rates for a sample DCE correspond to total spend by individual practitioners. Plus—see how we can determine the strength of beneficiary alignment to particular practitioners.

How CareJourney Can Help You Succeed

CareJourney specializes in providing the analytics required to understand attribution as well as other key metrics that measure provider performance within an APM. With our analytics platform, we enable organizations to assess the volume and performance of current and prospective providers and understand the composition of that volume. The attribution analytics described focus on DCEs, however the concepts and their applications can be applicable across a wide variety of APMs.

If you are interested in exploring how CareJourney’s analytics can help your organization succeed, we want to hear from you. If you are currently a member, please reach out to your member services representative for more information. If you’re not a CareJourney member, email us at jumpstart@carejourney.com, or you can learn more by requesting a meeting.

Not ready for a meeting? Check out our resources to learn how CareJourney helps payer, provider, and pharma organizations reduce the total cost of care and improve care quality.

- About the Program | CMS. (n.d.). CMS. Retrieved April 1, 2021, from: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/about

- Global and Professional Direct Contracting (GPDC) Model. CMS Homepage available at: https://innovation.cms.gov/innovation-models/gpdc-model

- Innovation Center Strategy Refresh. CMS. October 2021. https://innovation.cms.gov/strategic-direction-whitepaper

- Direct Contracting (Professional and Global): Frequently Asked Questions. CMS. October 2020. https://innovation.cms.gov/files/x/dc-faqs.pdf