By Sarah Grace and Blair Ford Mohney

Data Visualization by Cody Elias

CareJourney’s Network Advantage platform is largely built upon the full Medicare fee-for-service claims dataset, but it is used by members to draw insights about population health and quality of care for all Medicare enrollees. While fee-for-service and Medicare Advantage beneficiaries are sometimes considered as two distinct groups, these populations are fluid, as beneficiaries can switch enrollments in any given year. Focusing on this population of “switchers” has distinct benefits for payers and providers alike.

Over a series of two blog posts, we leverage longitudinal beneficiary-level enrollment data from 2013-2018 to look at the migration of patients between traditional fee-for-service Medicare and Medicare Advantage plans. By honing in on this population, we can begin to answer the following questions:

- Where are “switchers”? What can we learn from observing geographic enrollment trends over time?

- Who are “switchers”? Are they different from overall fee-for-service populations?

Applications

There are two particular advantages of focusing on the population of beneficiaries switching between traditional fee-for-service and Medicare Advantage.

- Plan Selection – By understanding what types of beneficiaries are switching into Medicare Advantage, health plans can effectively match populations with specific healthcare needs to the plans that best address those needs.

- Patient Care – By understanding common gaps in chronic condition coding between individual patients enrolled in fee-for-service one year, and Medicare Advantage the next year, providers can identify opportunities to more accurately capture the risk of their fee-for-service populations.

Coming out of the Blue Button Developer conference, there is particular interest in this “switcher” population; if these patients opt in to data sharing via Blue Button, there is significant opportunity to gain access to more complete data, more quickly, to “enable better care coordination, better patient outcomes and reduced costs” (as discussed in the CMS Interoperability and Patient Access Proposed Rule).

Where are “switchers”? What can we learn from observing geographic enrollment trends over time?

Methodology

For this analysis, we observe paired year-over-year enrollment between 2013-2018. In the “base” year, beneficiaries are classified based on a full year of enrollment in either fee-for-service or Medicare Advantage. In the following year, beneficiaries are grouped based on whether they continued in their current enrollment for the full year, switched enrollments for the full year, or neither (beneficiaries who died or switched enrollment mid-year are in this group).

Leveraging demographic data for all enrollees, and claims data for fee-for-service enrollees, we can understand the differences in chronic condition prevalence and other personal characteristics between fee-for-service to Medicare Advantage “switchers” and fee-for-service “stayers”.

We also pair this enrollment data with plan identification data to identify where switchers into Medicare Advantage enrolled, and whether significant trends exist for enrollees switching between Medicare Advantage plans.

Build and Optimize Networks of Care with Network Advantage

REQUEST A DEMO

Interactive Dashboard

Use the dashboard below to view Medicare Advantage penetration rates, fee-for-service to Medicare Advantage switch rates, and Medicare Advantage to fee-for-service switch rates over the past few years. In the first part of the dashboard, view national or state-level trends. In the second part of the dashboard, view trends for individual core-based statistical areas (CBSAs) of interest.

Note that national rates on the state-level charts in the dashboard below are raw state-level averages. Actual national rates can be viewed by selecting “National” on the CBSA-level charts.

Nationally, Medicare Advantage enrollment has steadily climbed from 2014 to 2018, and the fee-for-service to Medicare Advantage migration rate has held around 2%, with a slight uptick in 2017. At the same time, about 1-2% of beneficiaries have also switched out of Medicare Advantage each year.

However, we find much more variation when looking at specific markets. Access to plan-level enrollment data provides another layer of understanding of the market conditions driving some of these trends. A few particularly interesting cases are noted below.

Enrollment Surges

Connecticut saw a 10% jump in the statewide Medicare Advantage penetration rate between 2017 and 2018, with a 10.8% “switch” rate in 2018. This was largely driven by a surge in enrollment by fee-for-service patients in UnitedHealthcare plans, which gained over 36,000 new patients in 2018.

Following three years of consistent Medicare Advantage enrollment, Alabama saw a large 14.4% “switch” rate in 2017, with effects as large as 22% in CBSAs like Montgomery, yielding an 11% increase in the statewide Medicare Advantage penetration rate. This is largely attributed to UnitedHealthcare and BlueCross BlueShield of Alabama plans, which gained 62,000 and 20,000 beneficiaries from fee-for-service in 2017, respectively.

Enrollment Declines

While most states saw rising or steady Medicare Advantage enrollment, the Medicare Advantage penetration rate in Montana declined by 2% from 2017 to 2018, with markets like the Missoula CBSA having a 9.7% switch-out rate in 2018. At the same time, there was also significant migration between Medicare Advantage plans in Montana in 2018.

It’s Complicated

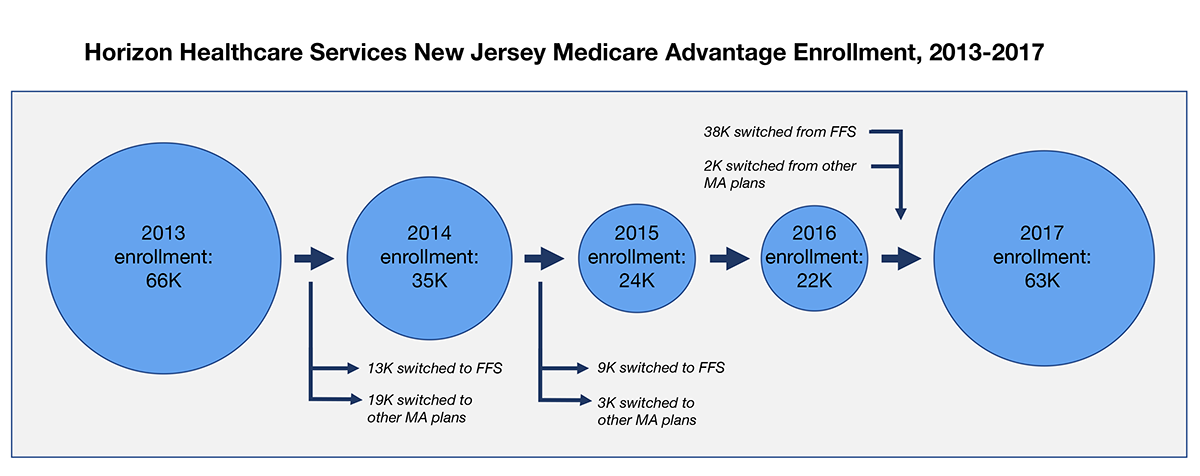

While New Jersey saw an increase in Medicare Advantage enrollment in 2017, the state saw a decrease in enrollment in 2014 and 2015, particularly in the Atlantic City, Ocean City, Trenton-Ewing, and Vineland-Millville-Bridgeton CBSAs.

The uptick in “switchers” in 2017 was driven largely by the enrollment of 38,000 fee-for-service beneficiaries in Horizon Healthcare Services plans. However, looking into the enrollment history for Horizon plans reveals more nuance, shown in the chart below.

Note that, in each year, in-migration and out-migration occurred, not all of which is highlighted explicitly in the chart above.

While Horizon plans had been losing enrollment prior to 2017, both due to beneficiaries switching back to fee-for-service as well as to other Medicare Advantage plans, it gained a significant number of enrollees from fee-for-service in 2017. Cases like this warrant further investigation into revised practices.

Interested in seeing more?

In the second part of this blog post series, we focus on the demographic characteristics and chronic conditions of “switchers” to evaluate the comparability of fee-for-service and Medicare Advantage populations.

If you’re interested in understanding more about the Medicare Advantage market dynamics that can be revealed using the complete Medicare enrollment data, we’d like to hear from you! Reach out to your Member Services representative or contact us at info@carejourney.com.

If you’re not a CareJourney member, learn more by requesting a demo below.

Build and Optimize Networks of Care with Network Advantage

REQUEST A DEMO