Congratulations! Your organization has been approved to join a value-based care payment model. Your provider contracts are signed, your attribution estimates are finalized, and you are preparing a primary care coordination strategy. Now, what comes next as you prepare for your upcoming performance year? It’s time to build out your preferred specialist network.

Fulfilling Network Needs at a High Level

Whether it is through the Medicare Shared Savings Program (MSSP), the Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH) Model, or any other value-based care program, an organization seeking strong performance and improved health outcomes will need to invest in a well-developed specialist network. While not a compliance requirement for value-based care programs, building out a specialist network that encompasses enough providers to adequately treat the needs of your patient population is crucial to developing the networks and pathways of care that will allow your organization to produce high quality, low cost care. This is your network’s “Amplitude”.

Ensuring a sufficient selection of providers are available for patients to receive necessary care is fundamental, but ensuring these providers perform in ways that advance the organization’s goals is essential to the success of value-based programs. In order to build out a high performing specialist network, value-based care entities need the ability to identify the right specialists for their organization and patient population. There are three key elements needed to identify these specialists:

- Organizations need demographic information about the specialists in their area of operations - where they are located, what their contact information is, and who they are.

- Organizations will need to understand the provider’s speciality and subspecialty in order to ensure that the specialists they work with are capable of effectively and efficiently treating the specific needs of their population. For example, value-based care organizations located in areas that are experiencing higher incidences of osteoarthritis resulting in lower extremity joint replacement find they specifically need foot and ankle surgeons in their network.

- Once organizations have identified the basic characteristics of their network needs, they will want to ensure that not only are the specialists capable of treating their patient population’s needs, but also that they are cost effective and have strong outcomes. In order to do this, organizations need a way to understand the complex interaction of acuity and cost to determine if providers are treating patients effectively and efficiently.

See Real-world Specialist Performance Data

To understand how this data can help you build your preferred specialist network, access our live dashboard containing cost and outcomes data for specialists in Arizona.

Key Components of Preferred Provider Selection

Determining the cost effectiveness of specialists is difficult, but there are three key elements that can help organizations select strong specialist providers and build their networks amplitude:

- Does the specialist provider have experience in value-based care?

- Does the specialist provider have significant volume of the specific procedures and episodes that are present in your patient population?

- Does the provider provide high quality, low cost care?

The following case study will demonstrate ways in which tools in the CareJourney “toolbelt” can help build a high performing panel of specialists that will take your organization down the road to success and increase your network’s amplitude.

Case Study

A health organization that primarily operates in Tucson, Arizona is embarking on their first year of a value-based care, payment incentive program. They are seeking out high performing physicians to serve as a well-rounded referral base for their patient population specifically.

After reviewing their current patient population and assessing the needs of the local community, this health organization realized three things: (1) that they had a high acuity patient population, and (2) that a large portion of their patients were suffering from eye-related and heart-related conditions, and (3) that building out a specialist network with those specialties will be critical to their success.

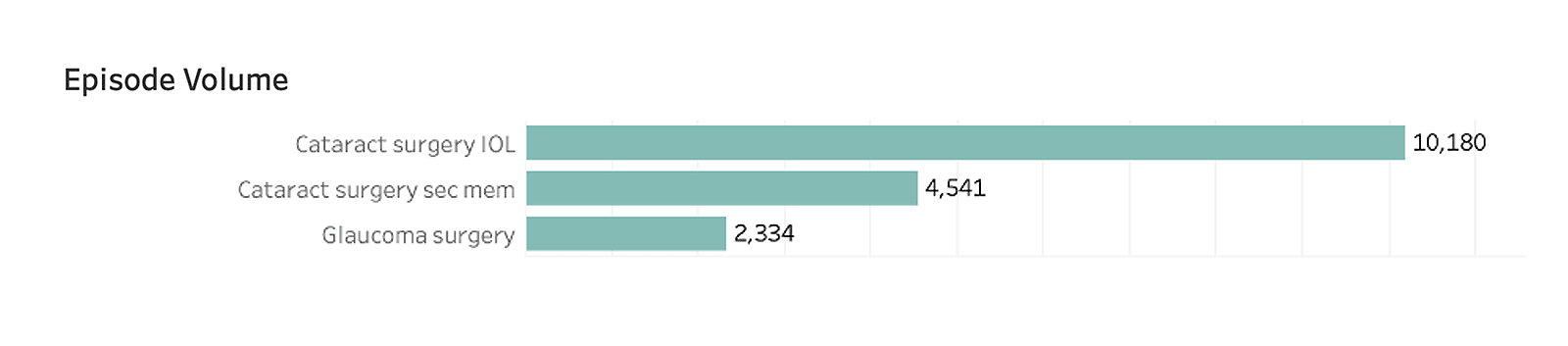

Prioritizing ophthalmology first, they dig into the types of eye-related episodes that are currently rendered in their CBSA. Identifying cataracts as the most common issue for their patient population, the organization has decided to focus on ophthalmologists who sub-specialize in that area. Understanding current population needs, which in this case is cataract surgery, can serve as an additional tool to help select preferred providers, ensuring they are the best fit to cater to those needs.

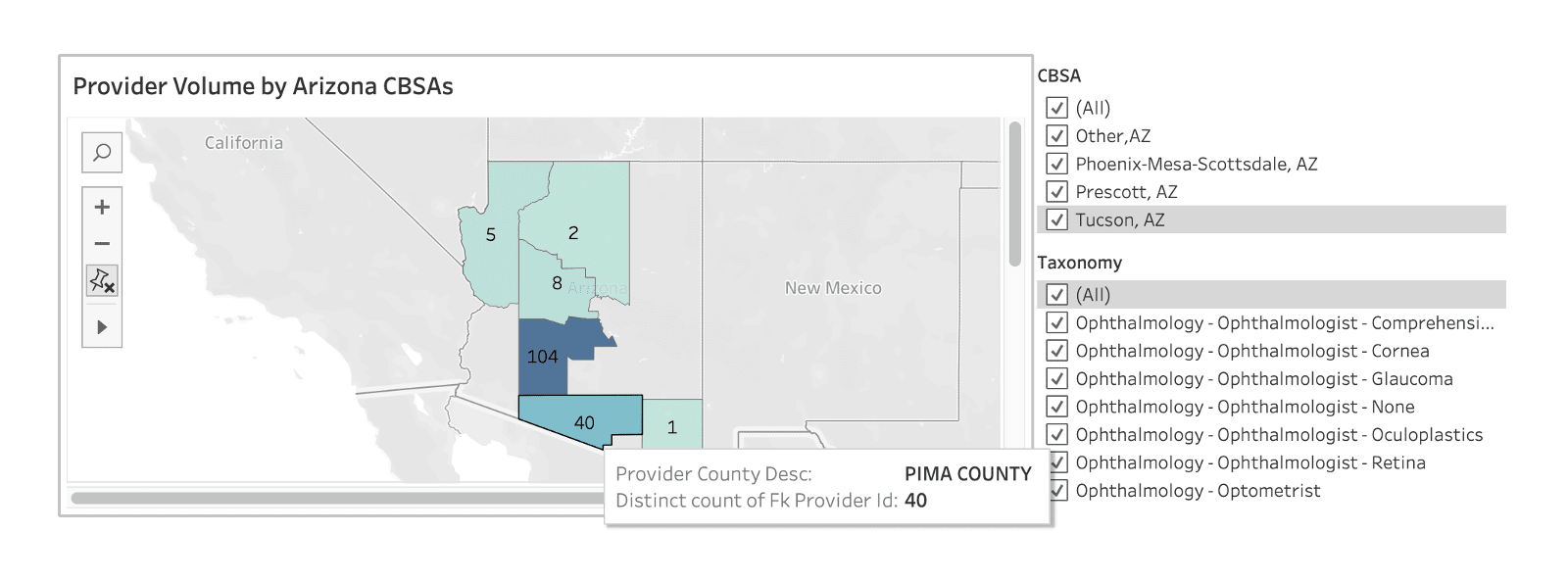

Next, they begin by honing in on the selection of providers that operate in their applicable core-based statistical area (CBSA), and further digging into to relevant subspecialties, derived from CareJourney’s taxonomy mapping:

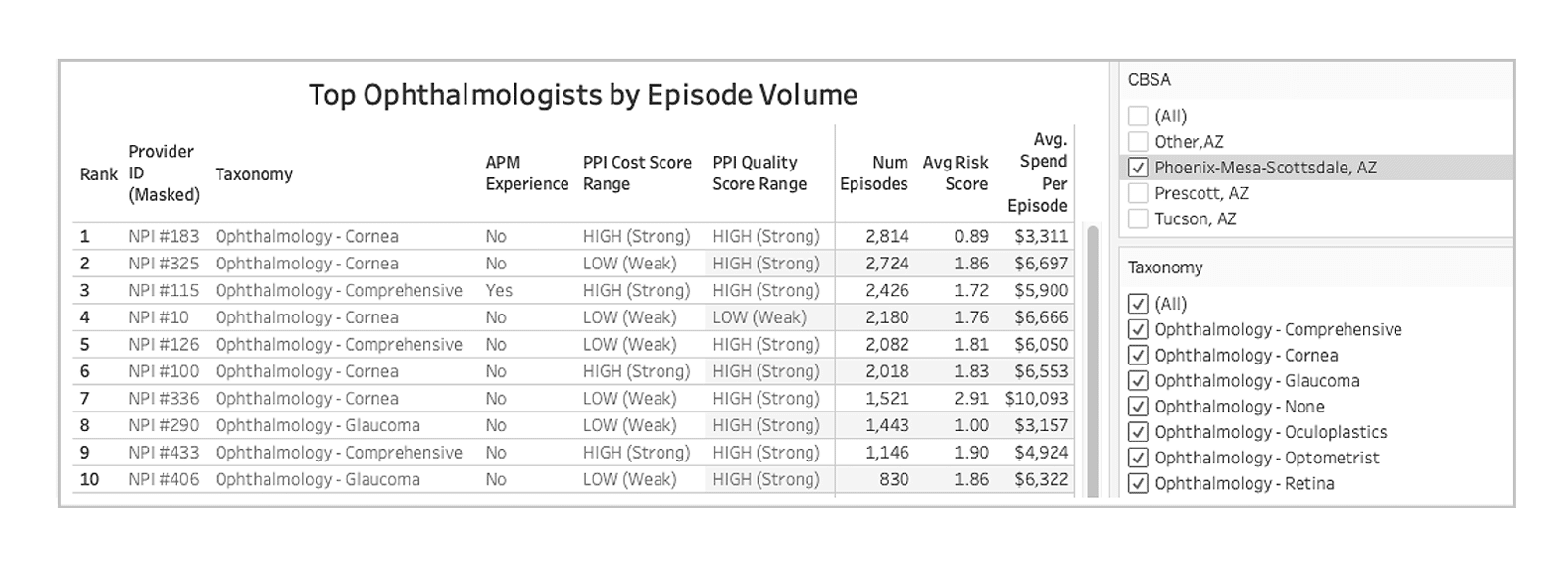

The next step is to narrow in on the ophthalmologists who not only operate in their region, but have sufficient volume in services needed for your population and/or have experience in alternative payment models (APMs). In this example, we’ve drilled down into the top specialists who perform the most cataract surgeries in the Phoenix CBSA:

* Masking provider IDs and raw CJ scores (Scores 1-2 = “LOW (Weak), Scores 3-5 = ”HIGH (Strong)”)

In addition to volume assessment, the CareJourney cost and quality scores, and acuity, the total medical spending associated with each episode type can be compared from one provider to the next, and allows network builders to evaluate all viable options in a given region. In this example the organization decided that NPI #183 and NPI #115 were a strong fit to engage in conversations about joining their specialist network. CareJourney’s robust provider data helped them choose the best ophthalmologist for their network.

Once the organization has identified cataract-treating specialists with experience in value-based care, the final step is to determine which specialists will complement their organization’s strategy to reduce costs. To determine this, the organization will want to select providers with strong performance on cost and quality scores, as well as those that treat significant episode volume, and treat a population that has a similar acuity. CareJourney’s cost and quality scores are reflected as a five-point rating scale that measures cost efficiency and quality outcomes based on patient episodes, instead of individual treatments or procedures. For a more in-depth look into our scoring methodology, refer to the CareJourney Provider Performance Index white paper.

Participating in the ACO REACH Model?

Learn how to be successful in the model.

Part of the Medicare Shared Savings Program (MSSP)?

Learn how to improve performance in MSSP.

How CareJourney Can Help You Succeed

CareJourney data opens up opportunities for market intelligence, performance assessment, and recruiting efforts in a more meaningful way with analytics that go deeper, including our Provider Performance Index. If you are interested in exploring how CareJourney’s analytics can help your organization succeed, we want to hear from you. If you are currently a member, please reach out to your member services representative for more information. If you’re not a CareJourney member, email us at jumpstart@carejourney.com, or you can learn more by requesting a meeting.