CareJourney and Turquoise Health Release the Most Up-To-Date Records on Hospital Price Transparency Data for Public Use

By Michael Underwood, Rishi Bhayana, and Catherine Flatley

June 24, 2022

On January 1, 2021, the Hospital Price Transparency Rule went into effect. This regulation has two key components. First, it requires hospitals to publish a machine-readable file for all items and services. Second, it requires hospitals to publish a set of 300 shoppable services in a consumer-friendly format.

A research letter posted in JAMA on June 7th noted modest hospital compliance based on a sample of hospitals reviewed mid-to-late 2021, similar to earlier reports. A more recent analysis by CareJourney and Turquoise Health, however, tells a different story, reporting a much larger percentage of hospitals providing meaningful transparency.

Aneesh Chopra, co-founder and President of CareJourney, recently recorded a podcast with Suzanne F. Delbanco, the Executive Director of Catalyst for Payment Reform (CPR), to talk about the current state of health care transparency policy. Aneesh summarized the key finding that “two-thirds of hospitals as of the spring of 2022… actually have meaningful, high-quality transparency data.”

This blog shares the data and the methodology behind the analysis as well as opens up the data file to the public for further research.

Building Upon the Turquoise Health Hospital MRF Price Transparency Scores and the Yale Tobin Center for Economic Policy Herfindahl-Hirschman Index (HHI) Hospital Data

In March 2022, Turquoise Health launched its beta Transparency Scorecard which assesses compliance by scoring hospitals on a scale of one to five, based on the completeness of their machine-readable files. According to the Turquoise Transparency Scorecard, files for hospitals with a score of level 4 or 5, are considered complete and their price transparency data is considered meaningfully transparent. On the other hand, a score of one means that there is no file and therefore they are considered non-compliant.

For our analysis, CareJourney added the Turquoise Health data for hospitals to two additional datasets. The first dataset is at the hospital level and based on the Centers for Medicare and Medicaid Services (CMS) Certification Number (CCN). For this linkage, we utilized CMS claims data to identify all short-term acute care facilities, then determine the total amount paid to a short-term acute care facility by CMS in 2021.

The second dataset used was the Herfindahl-Hirschman Index (HHI) hospital data published at the Yale Tobin Center for Economic Policy by Dr. Zack Cooper, in association with his working paper published in March 2022 entitled, “Do Higher Priced Hospitals Deliver Higher Quality Care.” HHI is a common measure of market concentration and is used to determine market competitiveness.

Findings from the CareJourney Analysis

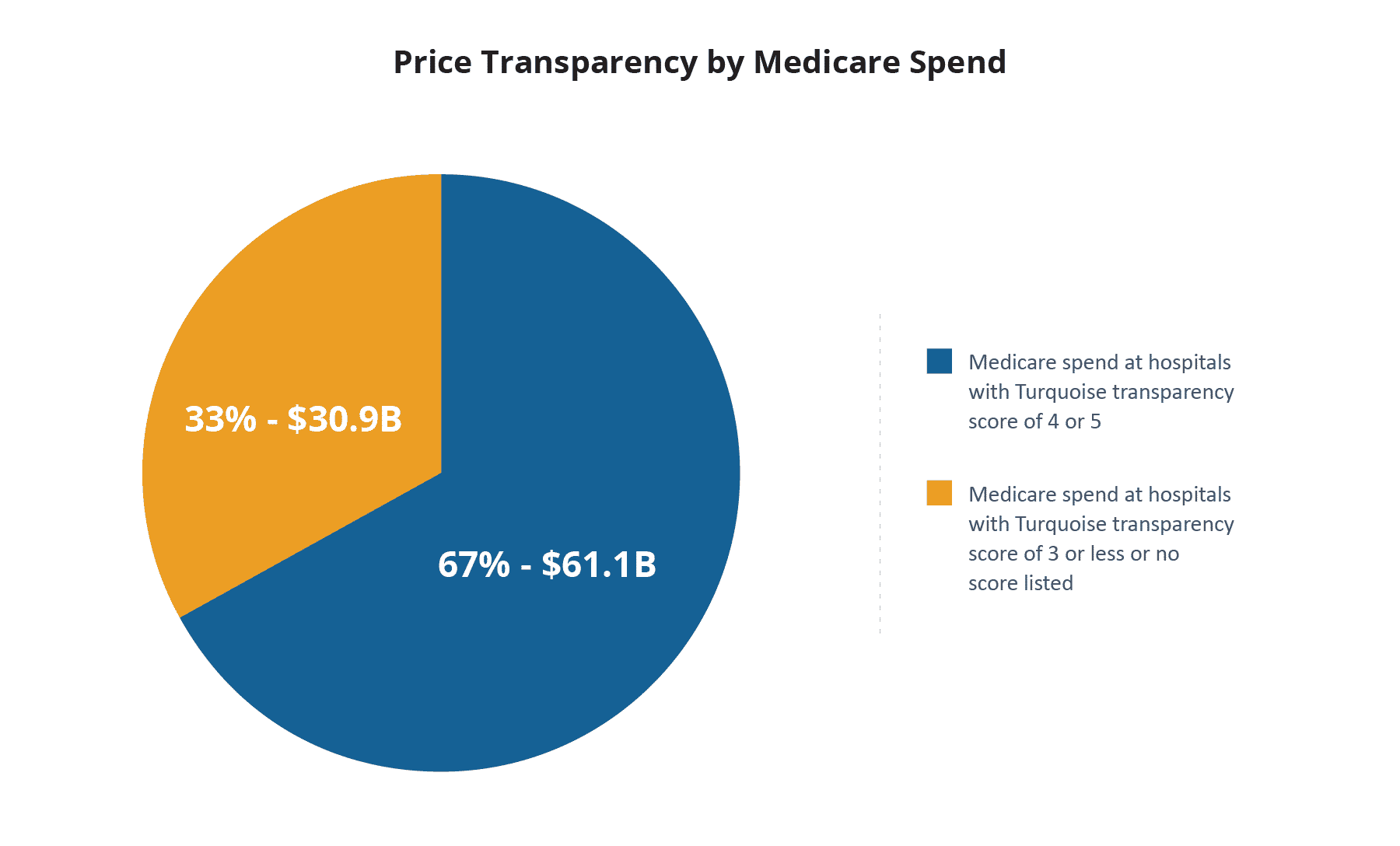

The CareJourney analysis found that about 67% of the short-term acute care facilities, by share of total Medicare spend, are meaningfully transparent (Turquoise transparency score of 4 or 5) with the price transparency regulations. That number falls to about 58% when calculating the number of facilities that are meaningfully transparent against the total count of hospitals with any Medicare spend.

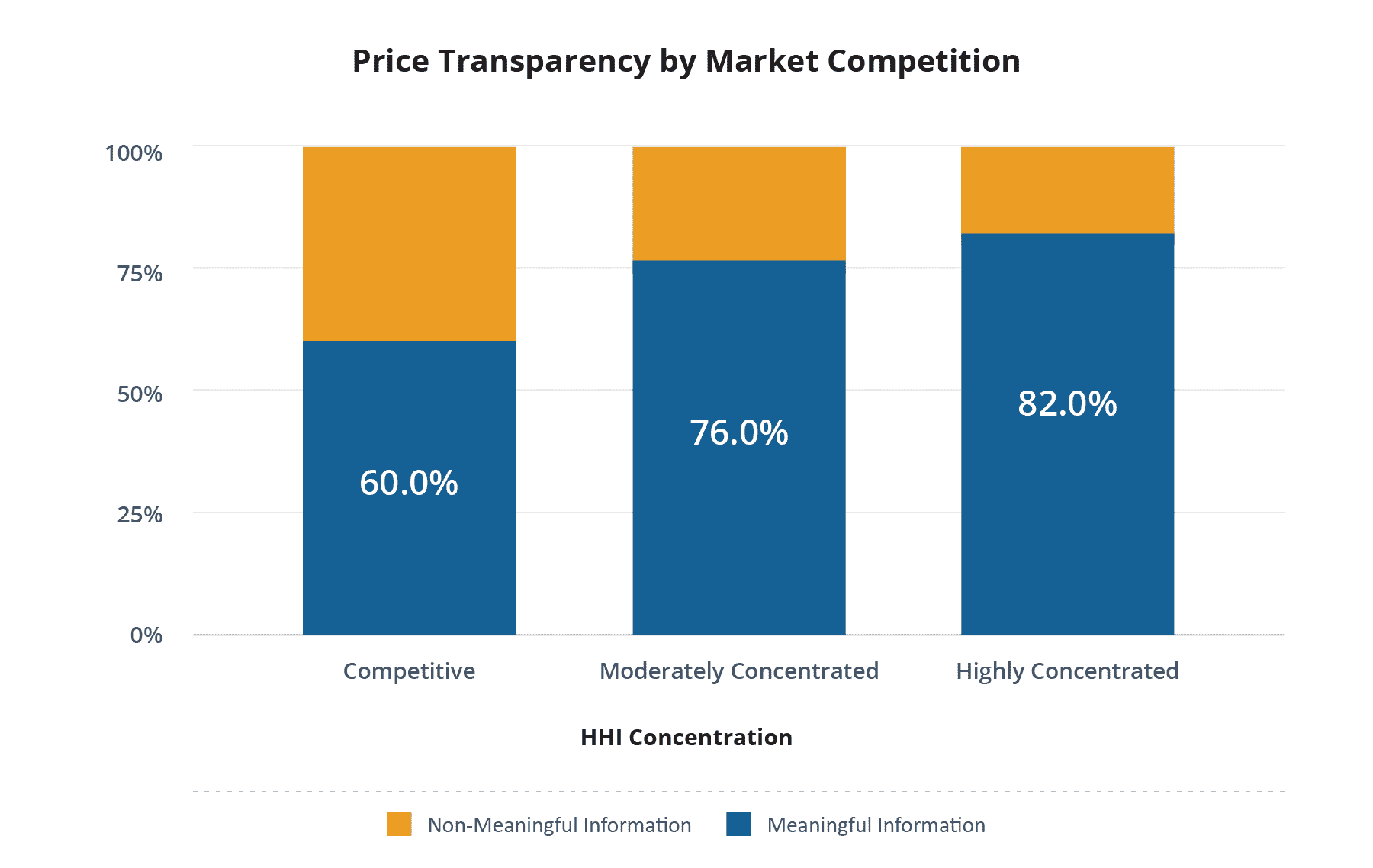

Additionally, more transparency was noted in markets of higher concentration. Of the 2,300+ hospitals with both HHI and transparency scores, the percentage of hospitals that posted meaningfully transparent data increased with market concentration.

Data Behind the Analysis

The CareJourney analysis joined datasets based on the CMS Certification Number (CCN) and was completed for over 3,400 short-term care facilities listed in 2021. Medicare spend is based on full-year 2021 data. The compliance score listed for the facility is based on the Turquoise Health data as of May 2022. HHI classification follows industry standards and is defined below.

- HHI less than 1500 was considered a competitive market

- HHI from 1500 to 2500 was considered a moderately concentrated market

- HHI above 2500 was considered a highly concentrated market

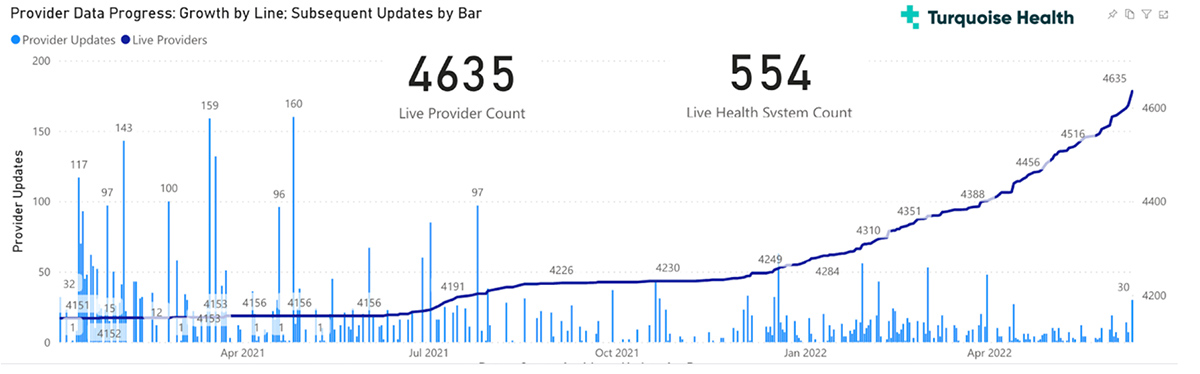

Finally, we referenced the dates by which Turquoise found provider updates to track progress over time (data as of June 2022):

It is clear that provider compliance has grown over time amidst greater CMS penalties (now up to $2M per hospital). More promising still has been the first set of enforcement actions, and perhaps most importantly, the forthcoming rule Transparency in Coverage Rule holding payers (including employers) accountable for disclosure on July 1, 2022. The files posted by payers will both provide data for hold-out hospitals available and standardize the output, making it easier for the public to use price transparency data.

Opening up the Data for Public Use

CareJourney is committed to opening up data for advancing value-based care and ultimately improving patient outcomes. Our mission is to empower individuals and organizations they trust with open, clinically relevant analytics and insights in the pursuit of the optimal healthcare journey. In the spirit of that mission, and with an appreciation for our partners at Turquoise, we are publishing a public use file to enable further research and analysis.

Check your downloads folder if you are not prompted to save the file elsewhere.

You can access the public data files for Turquoise’s Hospital Price Transparency Score here.

For media inquiries or questions related to this analysis, please email us at info@carejourney.com.