Better Patient Outcomes, Greater Shared Savings: The Case for Renewed Excitement in Value-based Care

By Erica Everhart

January 22, 2025

Controlling the rapidly increasing costs of healthcare is fraught with ethical conundrums, particularly around limiting access to care. After all, there are only so many ways to reduce healthcare costs – largely boiling down to (1) reducing utilization or (2) reducing the cost of services. Of the two options, reducing utilization was the focus of healthcare reform over the last decade.

In some cases, inadequate provider networks limit the number of “in-network” providers reducing the number of beneficiaries who can feasibly receive care covered by their insurance plan in a year. In other instances, a practice called prior authorization requires the insurance company’s approval of care in advance. These utilization management practices engender strong emotions from people who feel their health, or a loved one’s health was negatively impacted. These practices also create additional burden on already overtaxed providers.

As an alternate approach, value-based care seeks to price based on better health outcomes, not volume of services provided. The best examples are Medicare Shared Savings Program (MSSP) and Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH). Both of these programs fall under Traditional Medicare – ensuring the ultimate freedom of choice in providers, as well as no prior authorization. Under both of these programs, groups of providers form Accountable Care Organizations, or ACOs, who take on the financial risk and responsibility for the cost of care for the individual beneficiaries assigned to their ACO. These ACOs have a much-needed financial incentive to reduce costs. Yet, despite lacking the ability to dictate which providers their beneficiaries see, or the types of services or medicines they can receive, many ACOs are highly successful at saving money while providing high quality services.

How do they do this?

In part one of this blog series, we demonstrated how a top to bottom performance assessment allows ACOs to identify and act on impactful levers, track success, and ensure value.

In part two, we’ll dive into PY ’23 results by applying the same multi-layered data strategy to understand which ACOs generated greater savings and better patient outcomes.

Top Saving ACOs Have Fewer Admits, More Annual Wellness Visits, and More Transitions of Care Management

What is the “secret sauce” to attain savings? Is it replicable for other ACOs? Are there learnings that we can apply to commercial insurance and Medicare Advantage? Despite over a decade of consistent savings for the Medicare Shared Savings Program and the recent success of the ACO REACH program, a simple answer to this question remains elusive.

Each year, CMS publishes data summarizing the savings results for each MSSP and REACH ACO. From these files, we glean insights on whether physician led ACOs have more success than hospital led ACOs or whether more PCP visits per beneficiary is correlated with greater savings opportunities. However, understanding the steps to attain savings requires rigorous analytics, more granular data, and deep value-based care experience.

With that lens, the simple answer to this question is: ACOs achieve the most savings by treating their highest cost beneficiaries more effectively than expected, and more effectively than ACOs with losses. This suggests that better health outcomes come alongside greater savings.

Identifying Trends Across Top Saving ACOs

To begin, we broke the ACOs down into the following groups based on their PY 2023 shared savings results:

- Top Savers: those ACOs attaining greater than 10% gross savings.

- Middle Savers: those ACOs attaining between 5 and 10% gross savings.

- Low Savers: those ACOs attaining between 0 and 5% gross savings.

- Negative Savers: those ACOs experiencing gross losses.

** Please note: For MSSP, we selected ACOs that are in two-sided risk arrangements (risk tracks C, D, E, and Enhanced). For ACO REACH, we selected Standard and New Entrant ACOs.

Across those categories, we saw the following distribution in Table 1 with Negative Savers seeing lower quality scores.

Table 1: Summary Statistics from Public Use Files in PY 2023.

| # ACOs | # Beneficiaries | TCC PMPY | Quality Score | |

|---|---|---|---|---|

| ACO REACH | ||||

| Top Savers | 28 | 392,849 | $12,200 | 90.2% |

| Middle Savers | 37 | 690,093 | $12,636 | 78.4% |

| Low Savers | 31 | 644,719 | $13,032 | 89.7% |

| Negative Savers | 22 | 296,787 | $13,193 | 65.5% |

| MSSP | ||||

| Top Savers | 40 | 607,392 | $12,394 | 85.1% |

| Middle Savers | 109 | 2,547,124 | $11,825 | 85.0% |

| Low Savers | 128 | 3,890,474 | $12,384 | 83.5% |

| Negative Savers | 25 | 362,275 | $12,222 | 82.1% |

However, to unpack the impact for beneficiaries, we needed to compare utilization and quality performance. In order to create cross-program comparisons, we utilized CareJourney by Arcadia utilization measures applied to both sets of ACOs. Looking at the chart below, now only comparing top saving groups to those groups that did not achieve savings, a few differences emerge as outlined by Table 2:

- Top savings ACOs have fewer inpatient visits per one thousand beneficiaries (IP/1K);

- Top savings ACOs have a much higher annual wellness visit (AWV) rate; and,

- Top savings ACOs do more transitional care management (TCM).

Table 2: Utilization and Quality Performance Comparison Using CareJourney by Arcadia’s 2023 Data.

| Avg HCC | IP/1K* | % Avoidable ED Visits | % AWV | % Flu | % TCM | % of TCC that is Primary Care | |

|---|---|---|---|---|---|---|---|

| ACO REACH | |||||||

| Top Savers | 1.28 | 176 | 19.50% | 71% | 70% | 27% | 7.60% |

| Negative Savers | 1.06 | 207 | 20.40% | 47% | 79% | 16% | 7.70% |

| MSSP | |||||||

| Top Savers | 1.10 | 212 | 19% | 74% | 79% | 29% | 8% |

| Negative Savers | 0.98 | 259 | 20% | 57% | 74% | 22% | 8% |

*Note: these providers see patients that are both ACO aligned and not-ACO aligned. The data below represents the providers’ entire Medicare Fee for Service patient panel over the past three years (2021-2023). In addition, IP/1K has been risk adjusted.

Interestingly, both groups have the same rate of avoidable emergency department visits and same percent of total cost of care on primary care. With hospital inpatient costs being the single biggest component of overall health care spend, it stands to reason that ACOs who prevent hospital visits see greater savings.

But, how exactly do they best manage care?

Effective Care of Frail Elders as Foundation of ACO Success

As we highlighted in our last blog post, a multi-layered performance approach is critical to uncovering actionable insights. CareJourney by Arcadia’s Provider Intelligence data rates providers, practice groups, and facilities at an episode level along a suite of standard measures. To create these ratings, the provider’s observed performance is compared to a calculated expected value, creating an “observed to expected ratio.” When this ratio is greater than one, the provider is performing worse than expected. Conversely, a ratio of less than one indicates a provider is performing better than expected.

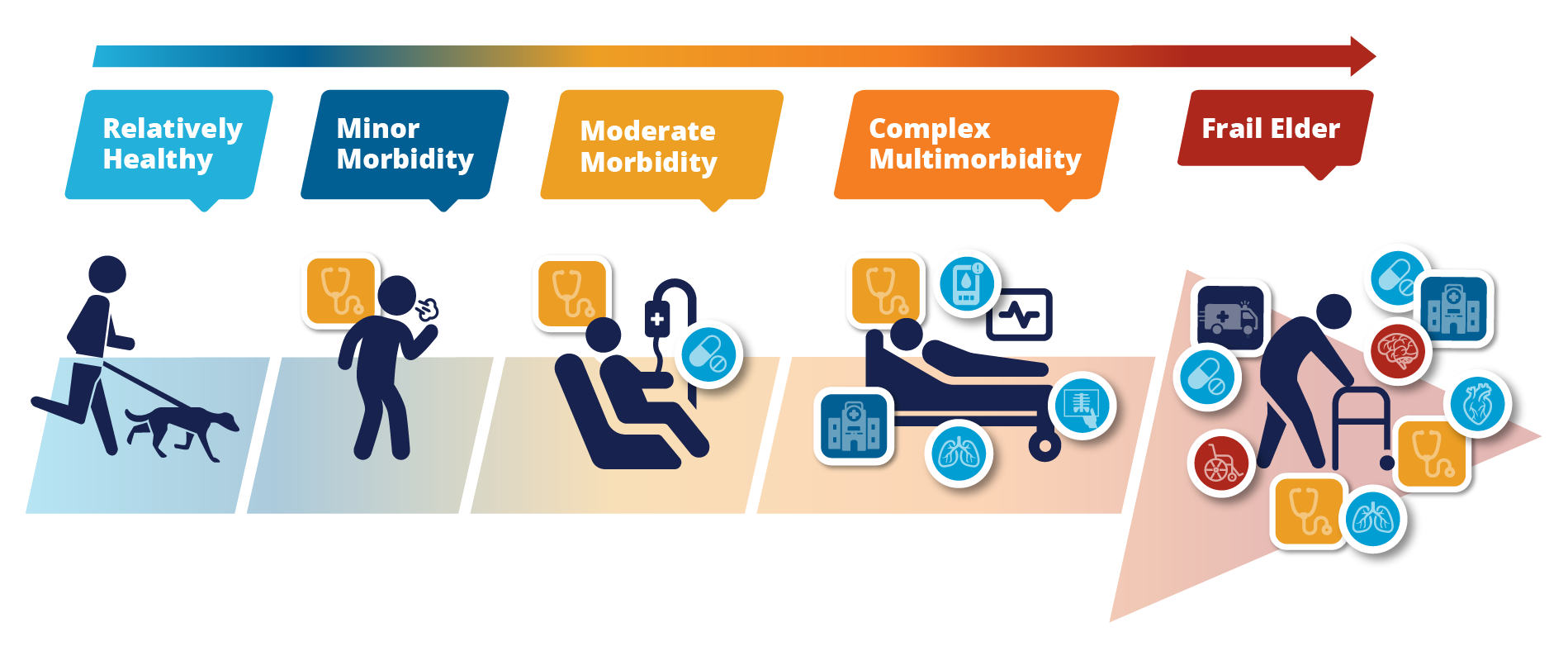

From a primary care perspective, the “Total Cost of Care” episode measures performance along several metrics for patients who receive the plurality of their primary care with the provider being rated. The Total Cost of Care episode has ratings for a providers overall patient population as well as by patient segments called “frailty cohorts” initially outlined in a seminal paper authored by Ashish Jha in 2017. In this paper, beneficiaries were separated into six cohorts: Under-65 Disabled/ESRD, Frail Elderly, Major Complex Chronic, Minor Complex Chronic, Simple Chronic, and Relatively Healthy. A patient was considered “high cost” if their annual health care expenses ranked in the top 10% of all patients. A patient in the Frail Elderly cohort (later updated to also include a high frailty score plus some form of functional or cognitive impairment) had a 42% likelihood of being deemed “high-cost” followed by patients in the under-65 disabled/ESRD cohort who had a 14% likelihood of being “high-cost.” The definitions of frailty cohorts have since been expanded to include another cohort: Serious Mental Illness.

This episodic approach applying the high-cost segmentation allows us to measure how primary care providers perform along both cost and quality measures within each cohort of patients – shedding light on how these Top Saver ACOs are better managing spend and outcomes. All trends hold for both MSSP and REACH ACOs; however, please note we’ve included results below for ACO REACH for readability.

Measuring Performance Across Segments

Note: these providers see patients that are both ACO aligned and not-ACO aligned. The data below represents the providers’ entire Medicare Fee for Service patient panel over the past three years (2021-2023)

Looking first at cost efficiency (Table 3), the Frail Elderly population has the highest total cost of care of across all the cohorts and is also one of the largest populations. The Top Savers group has an observed to expected ratio of 0.83 for the total cost of care of the Frail Elderly population, meaning their primary care physicians are treating their most expensive patients for 17% less than expected. The ACOs that did not attain savings are not performing poorly by any measure, but instead, exactly as expected for their frail elderly population. The “Unmanaged FFS” population is the segment of the population that is not in a REACH or MSSP ACO but does receive primary care, and thus are eligible for claims alignment.

Table 3: Cost Efficiency Observed to Expected Ratios

| Average Total Cost of Care: Observed to Expected, by Patient Segment ACO REACH PY2023 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Negative Savers | Top Savers | Unmanaged FFS (Assignable) |

||||||||||

| Frailty Cohort | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E |

| All | 100% | $16,075 | $16,283 | 0.99 | 100% | $14,265 | $17,109 | 0.83 | 100% | $17,612 | $17,119 | 1.03 |

| Frail Elders | 23% | $28,902 | $28,887 | 1.00 | 27% | $24,099 | $28,958 | 0.83 | 22% | $30,341 | $29,205 | 1.04 |

| People with Complex Multimorbidity |

16% | $15,101 | $15,560 | 0.97 | 18% | $13,086 | $15,940 | 0.82 | 13% | $16,118 | $15,828 | 1.02 |

| People with Moderate Morbidity |

27% | $9,304 | $9,731 | 0.96 | 25% | $8,600 | $10,056 | 0.86 | 23% | $9,548 | $9,568 | 1.00 |

| People with Minor Morbidity |

7% | $6,929 | $7,391 | 0.94 | 5% | $6,039 | $7,082 | 0.85 | 3% | $7,099 | $7,227 | 0.98 |

| Relatively Healthy | 8% | $6,450 | $7,089 | 0.91 | 4% | $5,989 | $6,663 | 0.90 | 27% | $6,755 | $7,167 | 0.94 |

| People with Serious Mental Illness |

9% | $13,499 | $13,821 | 0.98 | 11% | $10,723 | $13,446 | 0.80 | 6% | $13,906 | $13,872 | 1.00 |

| People with Major Disability |

10% | $24,923 | $24,524 | 1.00 | 10% | $20,047 | $23,367 | 0.92 | 6% | $26,847 | $25,872 | 1.04 |

Complications

Turning to complication costs (Table 4), Top Saver ACOs had 20% fewer complication costs than expected for the Frail Elderly population. This measure represents costs that are attributable to avoidable complications arising from surgical procedures or from a patient’s chronic conditions. Examples of avoidable complications are a hospitalization for complications due to asthma, or medical care for post surgical infections.

The group that did not attain savings performed slightly worse than expected with regards to these avoidable complications in the Frail Elderly cohorts, despite performing better than expected amongst all other cohorts.

Table 4: Complication Costs Observed to Expected Ratios

| Average Complication Costs: Observed to Expected, by Patient Segment ACO REACH PY2023 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Negative Savers | Top Savers | Unmanaged FFS (Assignable) |

||||||||||

| Frailty Cohort | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E |

| All | 100% | $4,070 | $4,029 | 1.01 | 100% | $3,143 | $4,015 | 0.78 | 100% | $4,435 | $4,298 | 1.03 |

| Frail Elders | 23% | $8,227 | $8,080 | 1.02 | 27% | $6,133 | $7,696 | 0.80 | 22% | $8,518 | $8,182 | 1.04 |

| People with Complex Multimorbidity |

16% | $3,074 | $3,147 | 0.98 | 18% | $2,310 | $3,063 | 0.75 | 13% | $3,214 | $3,255 | 0.99 |

| People with Moderate Morbidity |

27% | $1,867 | $1,932 | 0.97 | 25% | $1,410 | $1,827 | 0.77 | 23% | $1,877 | $1,897 | 0.99 |

| People with Minor Morbidity |

7% | $1,130 | $1,265 | 0.89 | 5% | $826 | $1,065 | 0.78 | 3% | $1,131 | $1,203 | 0.94 |

| Relatively Healthy | 8% | $1,430 | $1,613 | 0.89 | 4% | $1,092 | $1,359 | 0.80 | 27% | $1,453 | $1,625 | 0.89 |

| People with Serious Mental Illness |

9% | $3,597 | $3,760 | 0.96 | 11% | $2,157 | $3,234 | 0.67 | 6% | $3,822 | $3,776 | 1.01 |

| People with Major Disability |

10% | $6,946 | $6,716 | 0.99 | 10% | $4,909 | $6,072 | 0.88 | 6% | $7,497 | $7,184 | 1.04 |

Utilization

Looking at hospital utilization, both emergency room visits and inpatient admissions (Table 5 + Table 6), the Top Saver ACOs again performed about 20% better than expected with their Frail Elder cohort, as compared to the Negative Savers who performed right around as expected. This means that amongst the Frail Elderly population, the Top Savers ACOs prevented 20% of the hospitalizations that we would expect their beneficiaries to otherwise have in a year.

Table 5: ED Visits Per 1K Observed to Expected Ratios

| ED Visits per 1000 Person-Years: Observed to Expected, by Patient Segment ACO REACH PY2023 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Negative Savers | Top Savers | Unmanaged FFS (Assignable) |

||||||||||

| Frailty Cohort | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E |

| All | 100% | 453 | 467 | 0.97 | 100% | 367 | 461 | 0.80 | 100% | 474 | 472 | 1.00 |

| Frail Elders | 23% | 749 | 765 | 0.98 | 27% | 595 | 732 | 0.81 | 22% | 751 | 744 | 1.01 |

| People with Complex Multimorbidity |

16% | 356 | 377 | 0.94 | 18% | 287 | 369 | 0.78 | 13% | 367 | 373 | 0.98 |

| People with Moderate Morbidity |

27% | 287 | 299 | 0.96 | 25% | 226 | 292 | 0.78 | 23% | 287 | 289 | 0.99 |

| People with Minor Morbidity |

7% | 211 | 224 | 0.94 | 5% | 153 | 198 | 0.77 | 3% | 208 | 216 | 0.96 |

| Relatively Healthy | 8% | 217 | 248 | 0.88 | 4% | 173 | 218 | 0.79 | 27% | 224 | 243 | 0.92 |

| People with Serious Mental Illness |

9% | 538 | 614 | 0.88 | 11% | 335 | 511 | 0.66 | 6% | 591 | 599 | 0.99 |

| People with Major Disability |

10% | 644 | 661 | 0.98 | 10% | 512 | 611 | 0.92 | 6% | 650 | 676 | 0.96 |

Table 6: Unplanned Hospitalizations Per 1K Observed to Expected Ratios

| Unplanned Hospitalizations per 1000 Person-Years: Observed to Expected, by Patient Segment ACO REACH PY2023 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Negative Savers | Top Savers | Unmanaged FFS (Assignable) |

||||||||||

| Frailty Cohort | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E |

| All | 100% | 237 | 232 | 1.02 | 100% | 203 | 259 | 0.78 | 100% | 268 | 259 | 1.03 |

| Frail Elders | 23% | 502 | 490 | 1.02 | 27% | 415 | 520 | 0.80 | 22% | 537 | 514 | 1.04 |

| People with Complex Multimorbidity |

16% | 172 | 173 | 0.99 | 18% | 143 | 190 | 0.76 | 13% | 186 | 189 | 0.98 |

| People with Moderate Morbidity |

27% | 287 | 299 | 0.96 | 25% | 226 | 292 | 0.78 | 23% | 287 | 289 | 0.99 |

| People with Minor Morbidity |

7% | 97 | 99 | 0.97 | 5% | 81 | 106 | 0.77 | 3% | 102 | 103 | 0.99 |

| Relatively Healthy | 72 | 81 | 0.90 | 4% | 62 | 77 | 0.81 | 27% | 75 | 86 | 0.88 | |

| People with Serious Mental Illness |

9% | 197 | 204 | 0.97 | 11% | 132 | 204 | 0.65 | 6% | 222 | 219 | 1.01 |

| People with Major Disability |

10% | 414 | 396 | 0.98 | 10% | 327 | 407 | 0.88 | 6% | 462 | 440 | 1.05 |

Mortality

To round out our analysis, we considered differences in performance by cohort on mortality. Our findings drive home the point that better care not only yields lower overall costs, but better outcomes. Specifically, the mortality rate for Frail Elder beneficiaries in the Top Savings ACOs is two percentage points lower than the beneficiaries in the Negative Savings group and two percentage points lower than we expect it to be. This has a significant impact on overall outcomes for beneficiaries.

Table 7: Mortality Rate Observed to Expected Ratios

| Mortality Rate: Observed to Expected, by Patient Segment | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Negative Savers | Top Savers | Unmanaged FFS (Assignable) |

||||||||||

| Frailty Cohort | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E | % Pop | Obs. | Exp. | O:E |

| All | 100% | 3.0% | 3.0% | 0.99 | 100% | 2.3% | 3.2% | 0.73 | 100% | 3.7% | 3.5% | 1.07 |

| Frail Elders | 23% | 7.4% | 7.4% | 1.00 | 27% | 5.3% | 7.3% | 0.73 | 22% | 8.6% | 7.8% | 1.10 |

| People with Complex Multimorbidity |

16% | 2.0% | 2.1% | 0.96 | 18% | 1.6% | 2.1% | 0.75 | 13% | 2.2% | 2.2% | 0.99 |

| People with Moderate Morbidity |

27% | 1.0% | 1.0% | 0.99 | 25% | 0.7% | 1.0% | 0.70 | 23% | 1.0% | 1.1% | 0.99 |

| People with Minor Morbidity |

7% | 0.7% | 0.7% | 1.06 | 5% | 0.4% | 0.6% | 0.74 | 3% | 0.6% | 0.7% | 0.93 |

| Relatively Healthy | 8% | 0.7% | 0.8% | 0.87 | 4% | 0.6% | 0.8% | 0.77 | 27% | 0.8% | 0.9% | 0.92 |

| People with Serious Mental Illness |

9% | 1.4% | 1.5% | 0.94 | 11% | 1.1% | 1.5% | 0.70 | 6% | 1.6% | 1.6% | 0.97 |

| People with Major Disability |

10% | 4.9% | 5.0% | 0.93 | 10% | 3.8% | 4.9% | 0.87 | 6% | 6.5% | 5.7% | 1.15 |

A Proposed Model for Savings

With these findings in mind, the question becomes – What does this mean for models to reduce costs and provide better care?

Saving money on healthcare doesn’t have to mean insufficient networks, bad care, denied care, or obstacles to care. Through these results, ACO REACH and MSSP clearly demonstrate savings can come alongside choice and quality.

The behaviors of these high performing ACOs can serve as a blueprint for savings for other entities.

Step 1 – Focus on Neediest Patient Segment

If ACOs focus on meeting the needs of their neediest (and likely costliest) population, the Frail Elderly, they also excel in savings. Top Savings ACOs perform more care coordination services in the form of increased Annual Wellness Visits and increased Transitional Care Management services for their beneficiaries. Even just these two services are likely to have a halo effect. For example, if a patient has an Annual Wellness Visit with their provider, they are more likely to contact that provider for an illness that might progress to hospitalization before they land in the emergency room.

Step 2 – Prevent Lower Acuity Patients from Entering Highest Cost Patient Segment

In considering the Ashish Jha High-Cost Segmentation mentioned above, it is important to recognize that five of their patient segments represent a spectrum that a patient moves along as their chronic conditions progress.

With this in mind, identifying patients at risk of moving across the spectrum towards higher cost patient segments, and providing the care necessary to prevent disease progression is an obvious place for better outcomes and cost savings for ACOs.

As we outlined in our prior blog, combining near real-time claims data with CareJourney by Arcadia insights allows ACOs to get down to patient level, quickly identify patients with a “rising risk” profile, and intervene to give these beneficiaries a healthier, more cost effective care pathway.

Step 3 – Expand the “Secret Sauce” to All Beneficiaries

Once ACOs see success in managing their sickest populations, these learnings can broadly apply across all patient segments. By engaging in patient level analysis and identifying those with rising risk, primary care providers can provide care coordination and other wrap around services to minimize complications and give the best chance at good outcomes. A secondary effect of better health outcomes is cost savings for provider groups that have taken on the responsibility of those patients’ care.

This general approach is not ideologically complex, and applies to all populations: reduce spending in the most expensive areas, like hospitalizations, in order to see the biggest financial impacts. Reducing hospitalizations is best done by preventing them through stronger, primary care, with a particular focus on those patients most likely to experience a hospitalization. The difficulty – and it is difficult – is in identifying the right, most effective, interventions for the provider’s specific patient population. Patients face a myriad of issues from language barriers, transportation issues, elderly patients trying to navigate complex health systems and everything in between. Successful ACOs will create tailored, patient-centric, timely strategies to meet their patients’ needs.

Value-based Care Provides Hope for a Healthcare System in Distress

The idea of lower healthcare costs and better outcomes through strong primary care is exactly the definition of value-based care. Through MSSP and ACO REACH, we see its success without prior authorization or dictating which providers patients can see.

When strong primary care practices take on the risk of their patients’ total cost of care, as they do in most MSSP models and in ACO REACH, we will see a host of good outcomes – not just savings. As we learn more about the ingredients in the Secret Sauce of strong primary care, we are likely to find providers who facilitate trusted relationships with their patients steering them away from known low value care. We are likely to find providers understanding their patient panel and knowing how to utilize community-based support systems.

In short, if we can identify the ingredients of the Secret Sauce so that each practice can create their own version, we will naturally see an increase in high-value care, a decrease in low-value care, increased savings on healthcare, and happier, healthier patients.

Learning from the successes of the high performing Medicare ACOs can inform our entire national healthcare strategy. Employers who self-fund their employee health insurance are akin to a Medicare ACO. Their biggest expense is hospitalizations. They will provide the highest quality, best value care to their employees when they focus on identifying the riskiest populations and developing strategies to quickly and effectively meet those beneficiaries’ needs followed by expanding that strategy to all of their patient segments.

About CareJourney By Arcadia

Since its founding in 2014, CareJourney has believed in the importance of our nation’s transition to value-based care but recognized the absence of a reliable “operating manual” for delivering on its promise of better quality at lower costs. That’s why CareJourney’s mission is to empower organizations and the people they serve with open, clinically relevant analytics and insights to optimize healthcare journeys.

In 2024, CareJourney was acquired by Arcadia, blending clinically relevant cost, quality, and benchmark data into Arcadia’s next-generation healthcare data platform and workflow tools. Together, we enable organizations to grow high-performing networks, accelerate digital transformation, and achieve success in value-based care at speed, scale, and sophistication.